Evidence of the Fourth Turning Prophecy

How Millennials will usher in the Next American Revolution

Millennials, are lighting the way towards a new era for America, as they rise to the challenges of our time, forging a path towards a new era. Faced with a rapidly changing world, they navigate uncertainties with unwavering determination and an unyielding belief in their ability to make a positive impact. With unwavering optimism and a willingness to challenge the status quo, us millennials seize the opportunity to build a future that encompasses the aspirations and needs of all, ensuring a brighter tomorrow for generations to come. With an innate ability to adapt to changing circumstances, millennials embrace innovation and harness the power of technology to drive positive change. Rooted in the belief that the American dream should be accessible to all, they work tirelessly to dismantle barriers and pave the way for a better future. Millennials are reshaping the narrative, infusing hope and optimism into the very fabric of America, and leading us towards a future where dreams are not just realized, but transformed into shared realities.

That said, let me take some time to highlight some of the economic challenges facing the young generation. Then I will finish by infusing a good dose of hope back into the conversation.

A legendary investor gives a his take on our economic outlook.

Stanley Freeman Druckenmiller is an American investor, hedge fund manager and philanthropist. He is the former chairman and president of Duquesne Capital, which he founded in 1981. He closed the fund in August 2010. At the time of closing, Duquesne Capital had over $12 billion in assets. Druckenmiller made it big as a hedge fund manager for 30 years so when he has something to say it captures the investment world’s attention.

Recently, Stanley Druckenmiller gave a presentation at the 2023 Annual Meeting for the USC Marshall Student Investment Fund titled “US Exceptionalism At Risk?” You can read the full transcript and see his slides here. He also conducted an in-debt video interview which I’ve included below. Both of these are packed with data and information that I think is worth paying attention to.

First, Druckenmiller points out how much more aggressively the United States is spending on seniors compared to young people. He paints a stark contrast between two individuals: a senior citizen and a young person.

The scene captures the essence of the prevailing dilemma, highlighting the unequal distribution of entitlements and resources between the elderly and the youth.

Druckenmiller says,

“The share of fiscal spending going to seniors has been growing dramatically since the 1960’s when Medicaid and Medicare joined social security as federal entitlements. Today we spend 6x more per senior than per child in the US. Think social security vs education. Almost 40% of all our taxes are spent on seniors, and this trend is only starting. As the chart shows, we are just getting under way in terms of the fiscal consequences of the grey boom. In 25 years, spending on seniors will grow to take 70% of all taxes. Effectively, with entitlements compounding away, everything else gets squeezed.”

The demographic storm is just getting underway. We are already spending almost 40% of all taxes in seniors. In 20 years entitlements’ will cover 60% of all taxes.

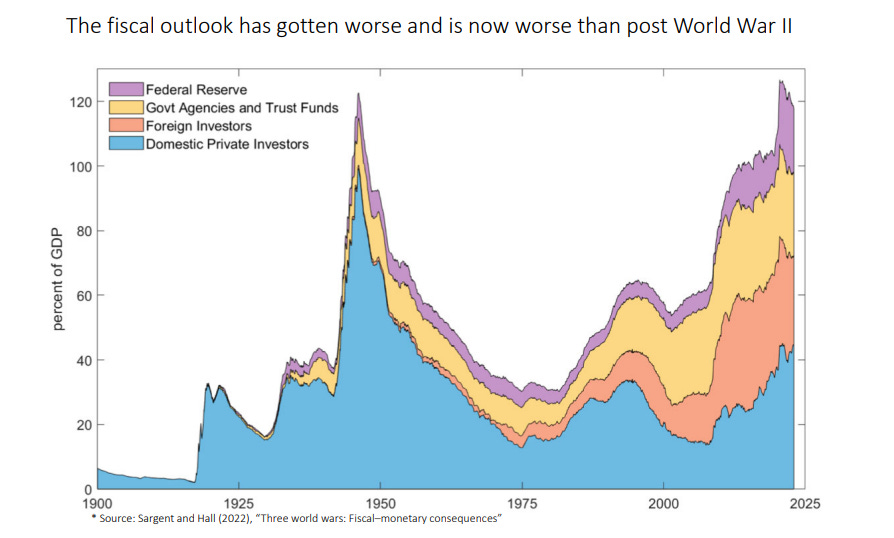

Next, Druckenmiller highlights how troublesome the national debt has become, especially when you begin to understand that trillions of dollars in future promises are unaccounted for in the current measurements.

“The fiscal recklessness of the last decade has been like watching a horror movie unfold. During the last decade, our debt grew from $15T to $31T today… a level of indebtment only comparable to that after WWII. But what is worse is that this debt does not account for what the government has promised it will pay you in terms of social security and Medicare. It actually assumes these payments will be ZERO. In the 1950s this “off‐the‐book” debt was small as baby boomers were just being born so actual debt was a reasonable measure of the country’s indebtedness. Not anymore. There are credible estimates that if you assume the government will pay the same to seniors in the future as it is paying today, the present value of that debt approaches $200T. That’s trillion with a “T.””

The part of this issue that I had not thought of, and Druckenmiller does a great job of illustrating, is how much the United States completely missed on correcting the deficit issue during the good times. He said,

“What makes the last 10 years particularly horrific is that we had some golden opportunities to reduce the fiscal gap ahead of the demographic storm that is under way. After WWI and II, the US quickly repaid its debt by raising taxes and restricting spending. Contrast that with today. After the GFC but pre covid, when the economy boomed in 2018 and the unemployment rate hit a 50‐year low, and even under a Republican administration, the deficit could not go lower than 5% of GDP! And then post covid, we had a booming economy where tax revenues were augmented by high inflation, over 10%, a windfall of taxes from capital gains due to the tech boom, all with 3.5% unemployment. So, you may reasonably ask, how much bigger was the surplus relative to that during the tech boom in the late 90’? Incredibly, as the chart shows, we ran a DEFICIT of over $1T. Never in history has a booming economy produced a worse fiscal result. Never. Expect this trend to continue absent radical policy changes.”

Druckenmiller continues by suggesting that it’s time to start cutting entitlements,

“It is time that we let go of the false pretense that cutting entitlements is a choice. It is not. Either we cut them today or we will have to cut them much more tomorrow.”

Here are some charts which illustrate Druckenmillers points above.

Ultimately, discussions surrounding entitlement programs and the financial burden on different generations involve complex considerations of fairness, intergenerational equity, societal welfare, and the values and priorities of a given society but that doesn’t excuse the looming problem here in America.

I post his video below and highly recommend watching if you have the time. If not, no worries, that’s what I’m here for. Here are some quotes he makes in the video I found amusing.

“When you have free money people do stupid things. When you have free money for 11 years people do really stupid things.”

“The debt ceiling debate is really depressing. I hope we don’t have a technical default. I think it would be stupid, I think it would be a market event, I think it would be a problem. It’s just amazing all the catastrophic forecast from government officials...all this talk about the debt ceiling is like siting on the Santa Monica Pier and you’ve got a 30 foot wave coming in and you’re worried about the Santa Monica Pier being damaged but you know that 10 miles out is a 200 foot tsunami...”

“The reserve currency is an unbelievable privilege, and unfortunately that privilege, while you have it, allows you, if you chose to do so, to run very myopic policies that don’t address the long term and allows you to behave in a way because markets don’t check you because you are being funded by outside sources. Everything we just described, the fiscal recklessness the monetary recklessness, all that, no other country could have pulled that off. It’s fun and great while it lasts but it enables you to keep digging and digging in a deeper hole until the consequences come to bear. Ironically…you lose the privilege and you only have the consequences. That’s why I call it the curse of the reserve currency.

The information that Druckmiller presents in this video, as well as his slides from the USC Marshall Student Investment Fund, sheds light of the fact we are living in a very trivial time and seriously begs the question what comes next?

The Fourth Turning is Upon Us.

This serious dilemma reminds me of a book I’m currently reading called The Fourth Turnings - An American Prophecy, by William Strauss and Neil Howe.

According to the book, a Fourth Turning refers to a cyclical pattern of historical cycles that occur approximately every 80 to 100 years. The authors argue that these turnings are characterized by distinct societal moods, challenges, and transformations. Each turning consists of four stages, or "seasons," which are comprised of the High, the Awakening, the Unraveling, and the Crisis.

In the authors' framework, a crisis turning represents a tumultuous and transformative period in which society faces significant challenges and undergoes profound changes. This is a time when old systems, institutions, and values are questioned and often replaced by new ones. Crises can be triggered by a range of factors, such as economic recessions, social upheaval, or geopolitical conflicts, and they tend to reshape the course of history.

Millennials, born between the early 1980s and the late 1990s, are believed to play a crucial role in this Fourth Turning. According to Strauss and Howe, they are the generation that will come of age and assume leadership positions during the Crisis. Millennials are seen as a highly diverse and civic-minded generation, shaped by significant events such as the September 11 attacks, the 2008 Global Financial Crisis spurred by negligent banks making subprime mortgage loans, and the COVID lockdown. Millennials are also born into the Information Age and new technological advancements (like Bitcoin and blockchain technologies).

The authors suggest that during the crisis turning, millennials will face immense challenges and will be called upon to address and navigate complex societal and economic problems. They believe that this generation will exhibit resilience, adaptability, and a strong sense of collective purpose as they work together to overcome the crisis and lay the foundation for a new era. Millennials are expected to challenge existing systems, introduce innovative solutions, and forge a new path forward for society.

In the context of the Fourth Turning, the authors emphasize that the collective actions and choices made by millennials and other generations will have a profound impact on the outcome of the crisis and the subsequent shape of society. The challenges faced during this period will test the resilience, determination, and vision of millennials, who are seen as key actors in shaping the future trajectory of civilization.

It's important to note that the concept of the Fourth Turning and the role of millennials presented in the book have generated both support and criticism. While some see value in the authors' cyclical theory and generational analysis, others argue that the application of such patterns to predict future events is speculative and lacks empirical evidence.

Empower Yourself: Take Control of Your Future and Wealth

In today’s dynamic world, the ability to take control of your financial wealth has become increasingly difficult to navigate.

Taking control of your financial assets and managing them independently without relying on a traditional bank or financial institution is an important skill to learn. It involves being solely responsible for storing, securing, and managing your funds, and using various financial tools and technologies to carry out transactions and investments.

In practice, being your own bank can involve using technologies such as cryptocurrencies, stablecoins, NFTs and blockchain-based decentralized finance (DeFi) platforms to securely store and manage your funds, carry out transactions without the need for intermediaries, and access a range of financial services such as lending, borrowing, and trading.

Being your own bank also comes with significant responsibilities, such as ensuring the security of your private keys and passwords, keeping track of your transactions and investments, and complying with relevant tax and regulatory requirements.

By understanding the power of these new technologies you can unlock a pathway towards financial freedom and security. The significance of learning and harnessing these tools will, enable you to build a strong foundation for your future.

Now is the time for you to open these doors to a realm of opportunities and unleash the power that comes with financial freedom. At Trading Tech & Consulting we help clients navigate these avenues and provide the potential for long-term growth, income generation, and a hedge against inflation. This includes education, making informed decisions, and options for generating passive or active income streams.

Trading Tech & Consulting help clients understand how to leverage new and traditional financial instruments and investment strategies. We empower people and help them navigate the complex world with confidence. We enable you to make informed decisions about your money and take control of your financial destiny.

By acquiring financial literacy, you become capable of identifying investment opportunities, assessing risks, and seizing the right moments to act. This knowledge equips you with the tools to weather market fluctuations and adapt to changing economic landscapes.

We believe that investing with a long-term perspective opens doors to wealth creation. Taking control of your financial wealth is not just about securing your own future but also leaving a lasting legacy for future generations.

I’ll leave you with one last quote from R Buckminster Fuller who says,

“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete”

Kind regards,

Tief

Jeffrey J. Tiefenthaler is the founder of Trading Tech and Consulting LLC. He is an experienced FinTech entrepreneur, accredited investor, and brand ambassador with two decades of experience trading in US stock and options markets, 15 years consulting for Microsoft brands such as Xbox, Windows and Office. He’s been featured in CoinMarketCap and awarded number one for articles with the highest views, top 10 for projects by Engagement Growth, top 10 for projects by community followers gained.