This Was Not on the Bingo Card

"Bitcoin is just like gold, except it's digital" - Chairman Powell

As one of the most influential figures in the global economy, the Federal Reserve Chairman holds a position of immense power and responsibility, with their decisions and guidance having a profound impact on the world's financial markets, economies, and ultimately, the lives of millions of people around the globe. Federal Reserve Chair Powell's recent comment that "Bitcoin is just like gold, except it's digital" marks a significant shift in the narrative surrounding the world's largest cryptocurrency. For years, Bitcoin enthusiasts have endured a rollercoaster of emotions, watching as the mainstream perception of their beloved asset evolved from ridicule to recognition.

As the saying goes, "First they ignore you, then they mock you, then they fight you, then you win." This quote has become a rallying cry for the Bitcoin community, which has faced its fair share of skepticism and scorn. Not so long ago, Bitcoin was dismissed as a "ponzi scheme" or a "fringe investment" by many in the financial establishment. However, as the asset has continued to grow in value and adoption, it's become increasingly difficult to ignore.

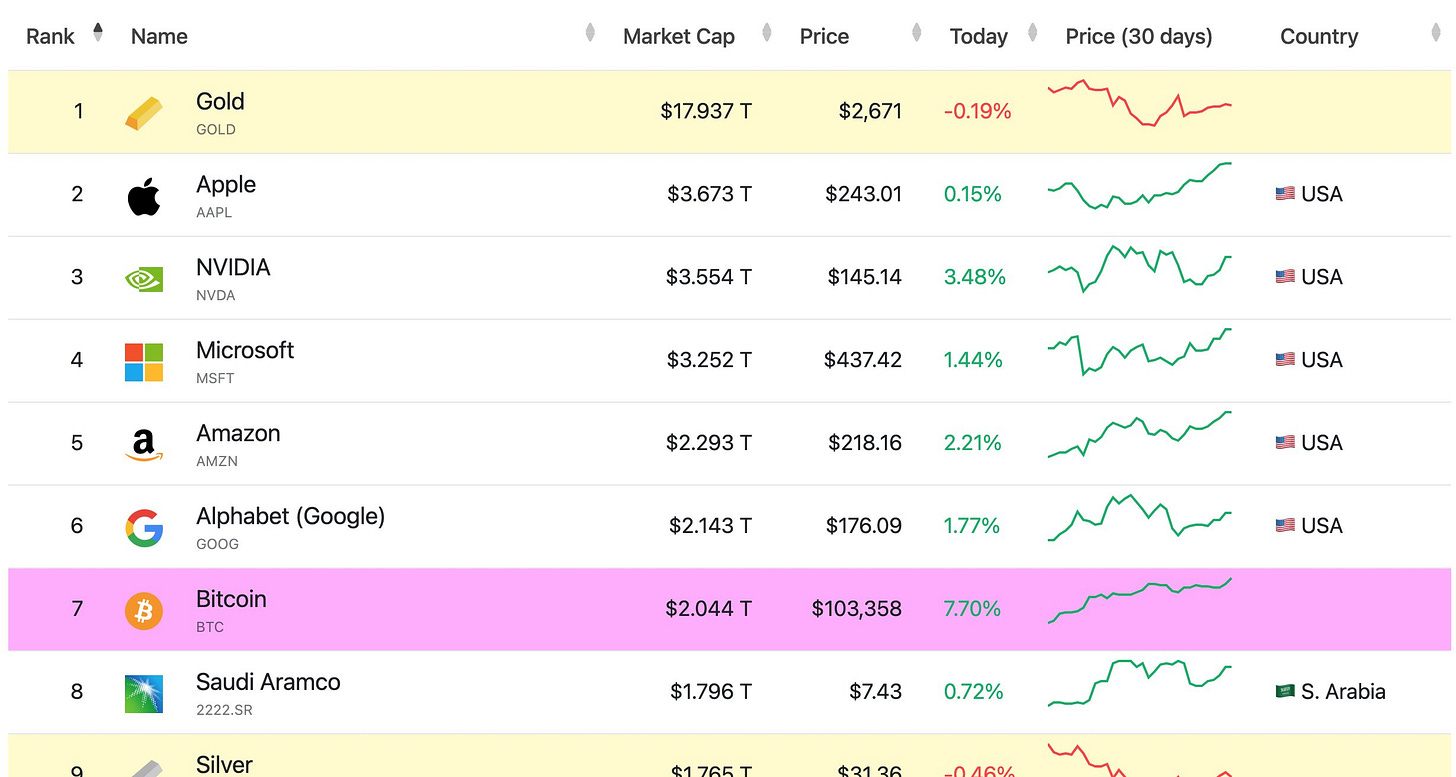

Powell's comment is a tacit acknowledgment that Bitcoin has earned its place alongside gold as a legitimate store of value. You can watch the 30 second video on my X account by clicking this link. This is a remarkable development, considering that gold has been the standard-bearer for safe-haven assets for centuries. With a market capitalization of approximately $17.9 trillion, gold is one of the largest asset classes in the world.

Meanwhile, Bitcoin's market capitalization stands at around $2 trillion, a fraction of gold's value. However, this gap is likely to narrow in the coming years. As Powell's comment suggests, Bitcoin is increasingly being viewed as a digital analogue to gold, with many of the same characteristics that make gold valuable – such as scarcity, durability, and portability.

In fact, Bitcoin has several advantages over gold that make it an attractive alternative. It's more divisible, easier to transfer, and more censorship-resistant than gold. These advantages suggest that Bitcoin's market capitalization should eventually surpass gold's, rather than simply matching it.

If Bitcoin were to reach the same market capitalization as gold, the price per coin would be approximately $907,777. This is a staggering figure, and one that may seem unrealistic to some. However, considering the vast disparity between gold's market capitalization and Bitcoin's, it's not unreasonable to assume that Bitcoin has significant room for growth.

In fact, a strong argument can be made that Bitcoin is at least 10 times better than gold, given its advantages in terms of portability, durability, and divisibility. These characteristics are highlighted in of of my favorite articles on Bitcoin and Money written by Vijay Boyapati, called The Bullish Case for Bitcoin. When people realize this truths Bitcoin's market capitalization should eventually exceed gold's, rather than simply matching it.

As the narrative surrounding Bitcoin continues to shift, it's clear that the asset is here to stay. With institutional investors, governments, and even central bankers like Powell acknowledging its value, the future looks bright for Bitcoin. As Gandhi's quote suggests, the Bitcoin community has endured the ignoring, mocking, and fighting – now it's time to win.

Kind Regards,

Jeff Tiefenthaler

LinkedIn: https://www.linkedin.com/in/jefftief/

X (Twitter): https://x.com/Jeffreytief

Website: https://almsofcrypto.money/