Fidelity Investments, one of the most powerful financial institutions on the planet with $5.8 trillion under management, just made a decisive move into blockchain.

They’ve filed with the SEC to launch the Fidelity Treasury Digital Fund, a tokenized version of their U.S. dollar money market fund that will live exclusively inside Fidelity’s own ecosystem and initially operate on the Ethereum blockchain. This is not a crypto gamble, it’s a calculated, institutional embrace of blockchain-powered real-world assets (RWAs). The fund is set to go live on May 30, 2025, pending approval.

This is a pilot, yes, but make no mistake: it’s also a blueprint for the future of finance.

This Is a Wake-Up Call

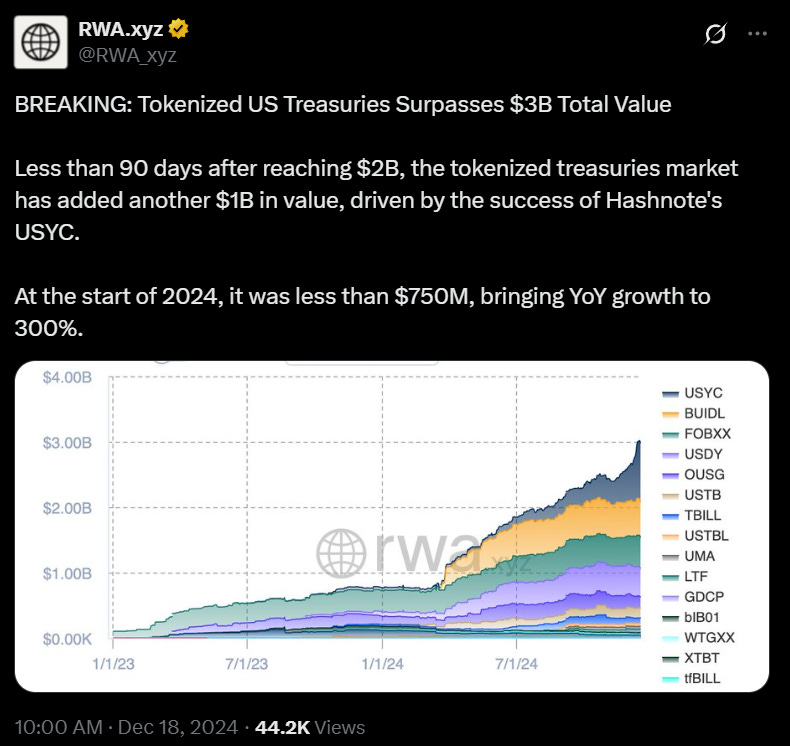

Tokenization is no longer a fringe experiment. It’s a multi-billion-dollar trend reshaping capital markets at warp speed. The tokenized U.S. Treasuries market alone has exploded 500% in the last year, now sitting at $4.77 billion. Check out this X Post from RWA.xyz last year highlighting the tremendous growth in tokenized treasuries.

Fidelity isn’t alone, BlackRock, Franklin Templeton, and Apollo Global are already deep into tokenized funds, including private credit, money markets, and other yield, generating products.

What’s changing? Access. Liquidity. Transparency. Automation.

Historically, assets like private credit were locked behind velvet ropes, six-figure minimums, multi-year lockups, no liquidity.

Now? Tokenization tears down those walls.

Ethereum: The Backbone of the Tokenized Economy

There’s a reason Fidelity, BlackRock, and Franklin Templeton are building their tokenized funds on Ethereum.

Ethereum and its Layer 2 solutions currently dominate the RWA space, commanding over 80% of the total market share. As of March 2025, Ethereum alone accounts for $4.6 billion in tokenized RWAs, with major L2s like zkSync contributing an additional $2 billion.

In contrast, competing blockchains like Stellar ($302.7 million), Solana, and Tron barely register.

Why the dominance?

Ethereum is the most proven, secure, and decentralized smart contract platform

Its L2s offer scalability, lower fees, and seamless integration with DeFi

It provides the liquidity and composability institutions require

That’s why heavy hitters are choosing Ethereum to tokenize U.S. Treasuries, private credit, real estate, and more, and why it will likely remain the “rails” of on-chain finance as this market accelerates.

I’m buying Ethereum today!

Most people think I’m a Bitcoin Maximalist. Truth is, I’m just Bitcoin First.

Yes, I always recommend accumulating BTC before diving into altcoins, but let’s get something straight: I’ve been an Ethereum investor since 2018, when it was trading under $100. I even went full nerd during the Proof-of-Stake migration, staking 64 ETH on two at-home nodes using Prysmatic Labs.

So when I say Ethereum is presenting another historical opportunity, I mean it. And today, I’m putting my money where my mouth is, buying more ETH exposure via the Ethereum ETF (ETHA).

📉 Just look at the chart:

ETH/BTC ratio: 0.022 – an extremely low historical level

RSI: 25.61 – deep oversold territory

Stochastic Oscillator: scraping the floor

They say, "Buy when there's blood in the streets." Well, there’s blood. And it’s Ethereum, colored.

And let’s not forget, Ethereum dominates over 80% of the tokenized real-world asset market. With major institutions like Fidelity, BlackRock, and Franklin Templeton choosing Ethereum as their blockchain of choice, this is not the time to bet against ETH.

Smart capital flows to where the infrastructure is winning. Right now, that’s Ethereum.

Staking & Supply Dynamics Are Bullish

As of March 31, 2025, there’s been a notable surge in the Ethereum validator queue, which reflects the number of validators waiting to start staking their ETH. This queue represents people or entities who have deposited 32 ETH (the amount required to become a validator) and are awaiting activation on the Ethereum network. The increase in the queue is often tracked via a chart showing "entries" (validators joining) versus "exits" (validators leaving), with recent data indicating a significant uptick in entries.

The reason for this spike is speculative but tied to anticipation of potential Ethereum ETF staking approval in 2025. If ETFs are allowed to stake ETH, demand for validators could increase, prompting "smart money" or large investors to front-run this possibility by joining the queue now. ETH is now a yield-bearing asset, thanks to proof-of-stake. When staking first became available the price went from under $500 a coin to almost $5,000 a coin. With new demand in the works, This incentivizes long-term holding and staking, removing supply from circulation. As more ETH gets locked into validators, the liquid supply decreases, while demand from institutional and retail players rises.

This is classic supply and demand imbalance, but on a decentralized, global scale.

Why It Matters for You

Here’s what blockchain-based investing makes possible:

Fractional ownership of high-yield private credit

24/7 tradability of tokenized assets

Real-time pricing based on smart contracts and risk metrics

Faster settlements and transparent, on-chain tracking

Access to formerly institutional-only opportunities

This isn’t just a new way to invest, it’s a complete overhaul of who gets to participate.

If you're still relying on legacy systems or waiting for mainstream finance to give you permission, you’re already behind.

I Can Help You Catch Up

I’ve spent years at the intersection of traditional finance and blockchain, from building trading algorithms and investing in Bitcoin early, to advising on tokenization and future-forward investment strategies.

If you’re a retail investor, family office, or asset manager looking to understand how crypto and tokenization will impact your portfolio, your business, or your future, you need someone who’s been ahead of this curve.

Let’s talk.

I can help you navigate this shift, build exposure to tokenized assets, and explore structures that will dominate the next generation of finance.

Schedule a 1:1 consultation today at https://calendly.com/jeffreytief/30min

Kind Regards,

Jeff Tiefenthaler

LinkedIn: https://www.linkedin.com/in/jefftief/

X (Twitter): https://x.com/Jeffreytief

Website: https://almsofcrypto.money/

Biography:

Hello, I'm Jeff Tiefenthaler, a digital asset investor and stock market trader. My career began as a consultant at Microsoft, where I discovered my passion for combining technology with financial markets. This led me to found Trading Tech & Consulting in 2017, where I helped develop over 300 stock and options trading algorithms with a 85%-win rate and average annual returns of 500%. My proprietary trading and investing systems have generated over $10 million dollars in returns for my partners over the past decade.

I’m looking forward to setting up a new investment company dedicated to preserving, growing and leveraging capital in the digital asset space across short, medium and long timeframes. This includes strategically allocating capital across traditional and decentralized financial markets.

I'm excited to learn and grow in this space, and I'm eager to connect with like-minded individuals who can offer guidance and support. I'm a firm believer that there's always room for growth and improvement, and I'm looking forward to expanding my knowledge and network in the fundraising arena. As Albert Einstein once said, "I am no genius. I'm just passionately curious" - a mantra that resonates deeply with me.