Where I draw the line with Bitcoin maximalism

A theological perspective and the importance of local currencies

As the son of a pastor raised in small community church, I have been exposed to the importance of money in the Bible since a young age. Jesus spoke more about money than any other topic in the Bible, and this is due to the fact that money has a profound impact on our lives and our relationship with God. Money can be a powerful tool for good, but it can also be a source of temptation and corruption. The Bible teaches us that money is a stewardship that we are to use wisely and responsibly. We are to use money to glorify God and to serve our fellow man. Jesus taught us that money can be a source of temptation, and that it is important to focus on spiritual matters rather than worldly possessions. He also warned us that the love of money can lead to corruption, and that greed can lead to sin. Money can also be a source of division and conflict. Jesus warned us that the love of money can lead to quarrels and disputes, and that it can cause us to lose sight of our spiritual values. He also taught us that money is not the most important thing in life, and that it is important to prioritize our spiritual relationships over material possessions.

Why a single currency is analogous to the anti-christ

In the Bible, the Antichrist is described as a figure of ultimate evil and deception, one who will attempt to deceive humanity and usurp the power of God. Likewise, the concept of a single global currency is seen by some as a similarly deceptive and dangerous force.

The idea of a single global currency is seen as a threat to individual and national sovereignty and autonomy, as it would take away the power of individuals and nations to create and control their own monetary policies. By replacing national currencies with one unified system, the power to set economic policies would be shifted to a single, centralized entity. In a theological context, this is seen as a dismissive act of God’s authority. By creating a single global currency, it is argued that the power to set economic policies would be taken away from the citizens of each nation, and placed in the hands of a single, centralized entity. This is already happening at a national level with central banks like the Federal Reserve and European Central Bank. In my opinion this has led to a world where powerful nations are manipulating the global economy for their own benefit, to the detriment of the rest of the world.

This type of control over the global economy has led to a world of inequality and injustice, and could potentially lead to the continued subjugation of more countries and cultures by the wealthy and powerful. To see proof of this we can look at the geni coefficient (link below). The Gini coefficient is an economic measure of inequality. It is used to measure the degree of inequality in a given population, and is based on the Lorenz curve. The Gini coefficient is calculated by dividing the area between the Lorenz curve and the hypothetical line of perfect equality (where everyone has the same income) by the area under the line of perfect equality. The resulting ratio is a value between 0 and 1, with 0 representing perfect equality and 1 representing perfect inequality. The Gini coefficient is commonly used to measure inequality in income distribution, wealth distribution, and other economic measures.

Back to the point, the Antichrist is seen as a figure of ultimate evil and deception, one who seeks to usurp the power of God. Similarly, the concept of a single global currency is seen as a deceptive and dangerous force, one which would ultimately take away the power of individual nations to create and control their own monetary policies. This could lead to a world of inequality and injustice like we’ve never seen before, one which is antithetical to the ideals of justice and fairness that are at the heart of God.

In Revelation 13:16-17 the bible discusses a mark associated with the "beast" and is said to be necessary for anyone who wants to buy or sell any goods or services. This mark is viewed as a symbol of allegiance to the beast and is seen as a sign of worshiping him. For this reason, the concept of a single global currency is analogous to the spirit of the Antichrist, a protocol that controls all financial transactions.

Is the US dollar is a single currency?

The US dollar is widely considered to be the world reserve currency, meaning that it is the currency of choice for the majority of countries for international trade and finance. This is largely due to the fact that the US dollar is the most traded currency in the world, and the US economy has historically been one of the largest and most stable in the world. As a result, the US dollar has become the de facto single currency for the world. The status of the US dollar as the world reserve currency has had far-reaching implications for the global economy and geopolitics. For example, when countries like Britain and France lost their status as world reserve currencies in the 19th century, they were forced to go to war in order to maintain their global influence and power. Similarly, following World War II, the US dollar replaced the British pound as the world reserve currency, and this shift in power was seen as a major contributing factor to the Cold War between the US and the Soviet Union.

The US dollar has been losing its status as the world reserve currency. Countries like China, Japan, Russia, and Saudi Arabia have been reducing their purchase of US Treasury bonds. China has been reducing its purchases of US Treasury bonds since 2018, and in 2020 it became the first country to sell more US Treasury bonds than it bought since 2009. Japan has also been reducing its purchases of US Treasury bonds since 2018, and in 2020 it became the second-largest holder of US debt. Russia and Saudi Arabia have also reduced their purchases of US Treasury bonds in 2020.

In cases where the loss of world reserve currency status happened it was seen as a major contributing factor to the outbreak of wars. Today, the US support of the Ukraine war could be argued to be motivated by the fact that the US is losing its status as the world reserve currency.

This shift in the global economy has had far-reaching implications for the US. As the US dollar has been losing its status as the world reserve currency, the US has seen a subtle decline in its ability to influence global markets and geopolitics. The US support of the Ukraine war could be seen as an attempt to reassert its global influence and maintain its status as the world reserve currency. By supporting a country that is strategically located between Russia and the EU, the US is attempting to maintain its global influence and prevent further erosion of its status as the world reserve currency.

Where I draw the line with Bitcoin Maximalists

Before sounding like a bitcoin bear I want to say that working for a cryptocurrency company gave me unique insight into the importance of Bitcoin as one of the only legitimate cryptocurrencies. During my time there, I saw firsthand how a small group of founders can take advantage of the community by pushing hype and hope and not following through on promises. This is in order to get people interested in an inferior coin. This ultimately led me to walk away from my position working there and reinforced my belief that Bitcoin has many advantages, including Metcalfe’s law.

Bitcoin is the safest of all cryptocurrency due to it’s truly decentralized nature. It has been time-tested and remains a reliable option for users all around the world. Crypto companies or projects that deviate way from the cypherpunk ethos that Bitcoin has adopted into it’s protocol are heading in the wrong direction. Bitcoin, the future of energy & money, will continue to be the gold standard for cryptocurrencies because there isn’t a board of directors, CEO or shareholders to influence and manipulate the future direction of the blockchain protocol.

To preface, it’s true that some Bitcoin maximalists believe that Bitcoin will eventually become the single world reserve currency. They argue that Bitcoin’s decentralized nature, its security and its scarcity make it the perfect choice for a global currency. They point to Bitcoin’s low transaction costs, its lack of counterparty risk and its immutability as advantages over other currencies. They also argue that Bitcoin has the potential to be adopted as a global currency because it is not controlled by any government or central bank. Furthermore, some Bitcoin maximalists argue that the world needs a single, global currency to reduce the risk of currency manipulation and to make it easier for people to conduct international trade. They argue that Bitcoin, as a decentralized and borderless currency, is the perfect choice for a global currency. Additionally, they point to the increasing acceptance of Bitcoin by merchants, exchanges and governments around the world as evidence that it is becoming more widely accepted and is on its way to becoming the world reserve currency.

I agree with all these things, but where I draw the line with Bitcoin maximalists comes from my theological upbringing and belief that a single one-world currency connotates the spirit of the anti-christ IF it removes the ability and power of individuals and nations to create and control their own monetary policies. One example would be removing the ability to convert local currencies into a common currency. Moreover, a single currency is not anti-fragile because if it were to fail suddenly without an alternative to fall back on than we would be back to the barter system overnight. There is no escaping a financial system without alternatives. Bitcoin is the best currency ever created, but there is a non-zero chance that the bitcoin protocol can be attacked. Bitcoin is a lifeboat for people to escape from the dying fiat financial system, but it should not replace one form of maximalism for another. Bitcoin is the hardest money ever created because it’s supply is capped at 21 million, but it must be easy for people to transfer in and out of it.

From a theological perspective, Bitcoin could be the best escape from the anti-christ during the end-times the bible speaks of, but that doesn’t mean it should become the only form of money in existence either.

Local currencies and other cryptocurrencies matter

Local currencies have been a powerful tool for economic stability and growth throughout history. By allowing local economies to operate independently of the global economy, local currencies can help to preserve local cultures, foster economic resilience, and provide an alternative to globally-controlled currencies. Local currencies can help to promote economic stability by helping to insulate local economies from the booms and busts of global markets. This can be particularly beneficial for rural and remote areas that might not be as connected to the global economy as urban centers. By using a local currency, these areas can create a more stable and sustainable economic environment for businesses and individuals.

Local currencies can also help to promote economic growth by providing a new avenue for investment. By creating a local currency, businesses can invest in their local economies and help to create new jobs and economic opportunities. This can help to create a more vibrant and diverse local economy, which can lead to greater economic prosperity. Additionally, local currencies can help to preserve and promote local cultures and values. By allowing local economies to operate independently of the global economy, local currencies can help to preserve the unique characteristics of a region or culture. This can be particularly beneficial in areas that are at risk of losing their culture due to global economic forces.

Some examples of local currencies include BerkShares in The Berkshires region of Massachusetts, Bristol Pound in Bristol, UK, and Chiemgauer in Chiemgau region of Germany. Miami coin is also an example of a local digital currency that was created to support Miami’s economy.

Common currency NOT single currency

A common or global currency is important for fostering international trade. With a stable common currency, different countries can trade with each other without worrying about exchange rate fluctuations.

This makes it easier for businesses to trade goods and services across borders, which can lead to increased economic growth and increased competition. Additionally, a common currency makes it easier for countries to borrow money from each other and invest in each other’s economies. This can lead to increased investment in infrastructure and other aspects of economic development, which can lead to increased economic growth. Furthermore, a common currency can help to foster international cooperation by making it easier for countries to work together on global issues. Without a common currency, countries would have to rely on different currencies and exchange rates, which can lead to confusion and difficulty in coordinating international efforts. With a common currency, countries can easily cooperate on global issues and work together to solve global problems. In conclusion, a common currency is not forced upon local or regional economies but is important for fostering international trade between local and regional economies. It makes it easier for businesses to trade across borders, and it makes it easier for countries to borrow money and invest in each other’s economies.

In reality, the US dollar’s status as the global common currency is in jeopardy and it’s plainly obvious that government issued fiat currencies do not provide the stability needed for international and global commence. It’s time to face reality, whether you like it or not, Bitcoin is the best solution for a common currency.

Prior to the US leaving the gold standard, currency exchange rates were based on the value of gold, meaning that currencies were pegged to the price of gold. This meant that exchange rates were relatively stable, as the price of gold remained relatively constant for long periods of time. However, since the US move away from the gold standard, currency exchange rates have become increasingly volatile. This is due to the fact that exchange rates are now determined by a variety of factors, such as economic and geopolitical developments, supply and demand, and monetary policy. Increasingly frequent exchange rate fluctuations happen more regularly, as currencies are no longer pegged to a single standard like gold.

Examples of exchange rate fluctuations since the US move away from the gold standard include the US dollar’s appreciation against the Japanese yen in the 1980s, the US dollar’s appreciation against the British pound in the 1990s, and the euro’s appreciation against the US dollar in the early 2000s. These fluctuations demonstrate the increasing volatility of currency exchange rates since the US move away from the gold standard.

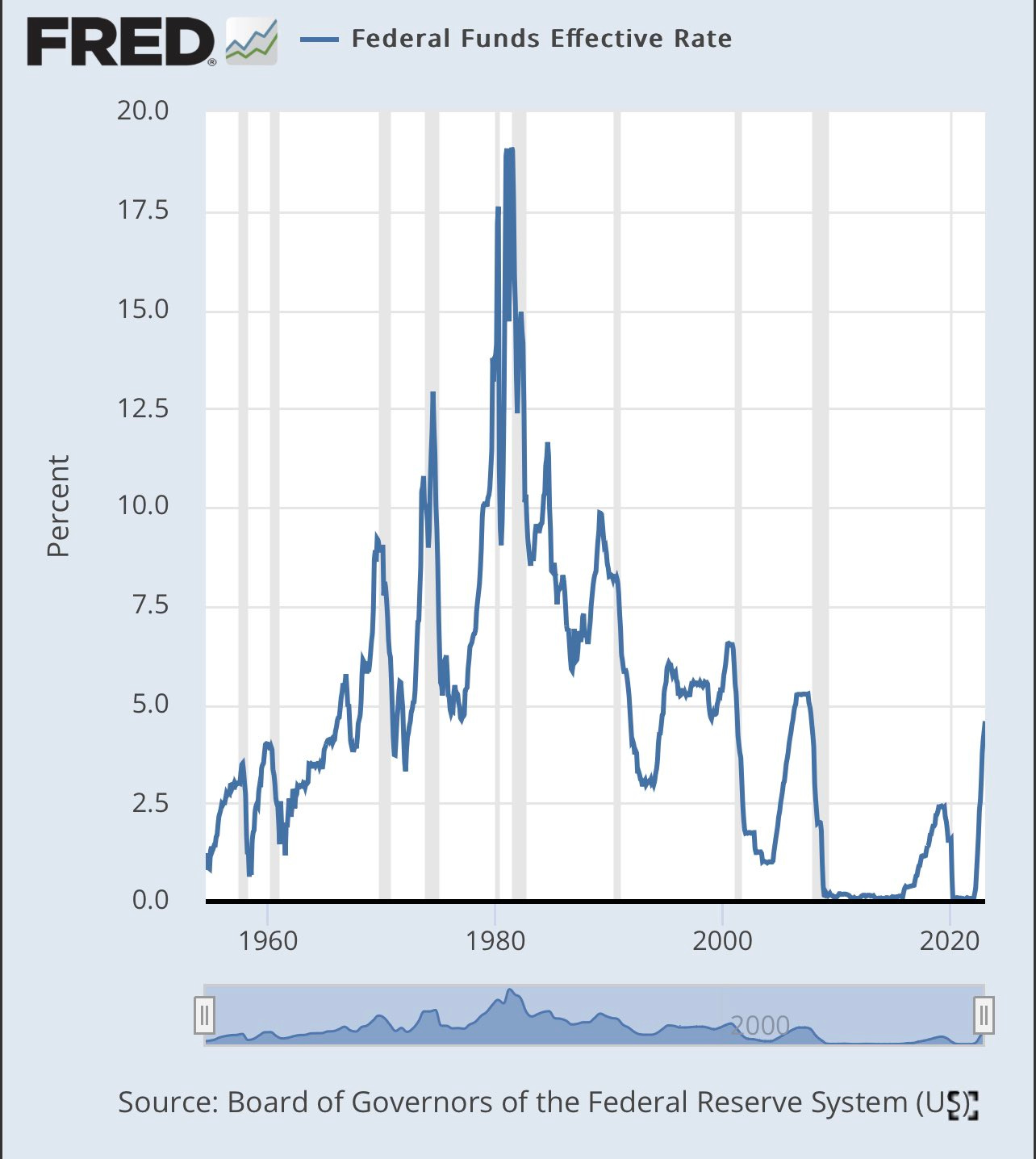

Comparing the monetary policy of bitcoin versus the US Federal Reserve one can see how chaotic the US monetary policy is versus how predictable and stable the bitcoin monetary policy is. The first chart shows the Federal Funds Effective Rate (FFER), which is the average interest rate at which depository institutions lend balances to each other overnight. Notice the volatility?

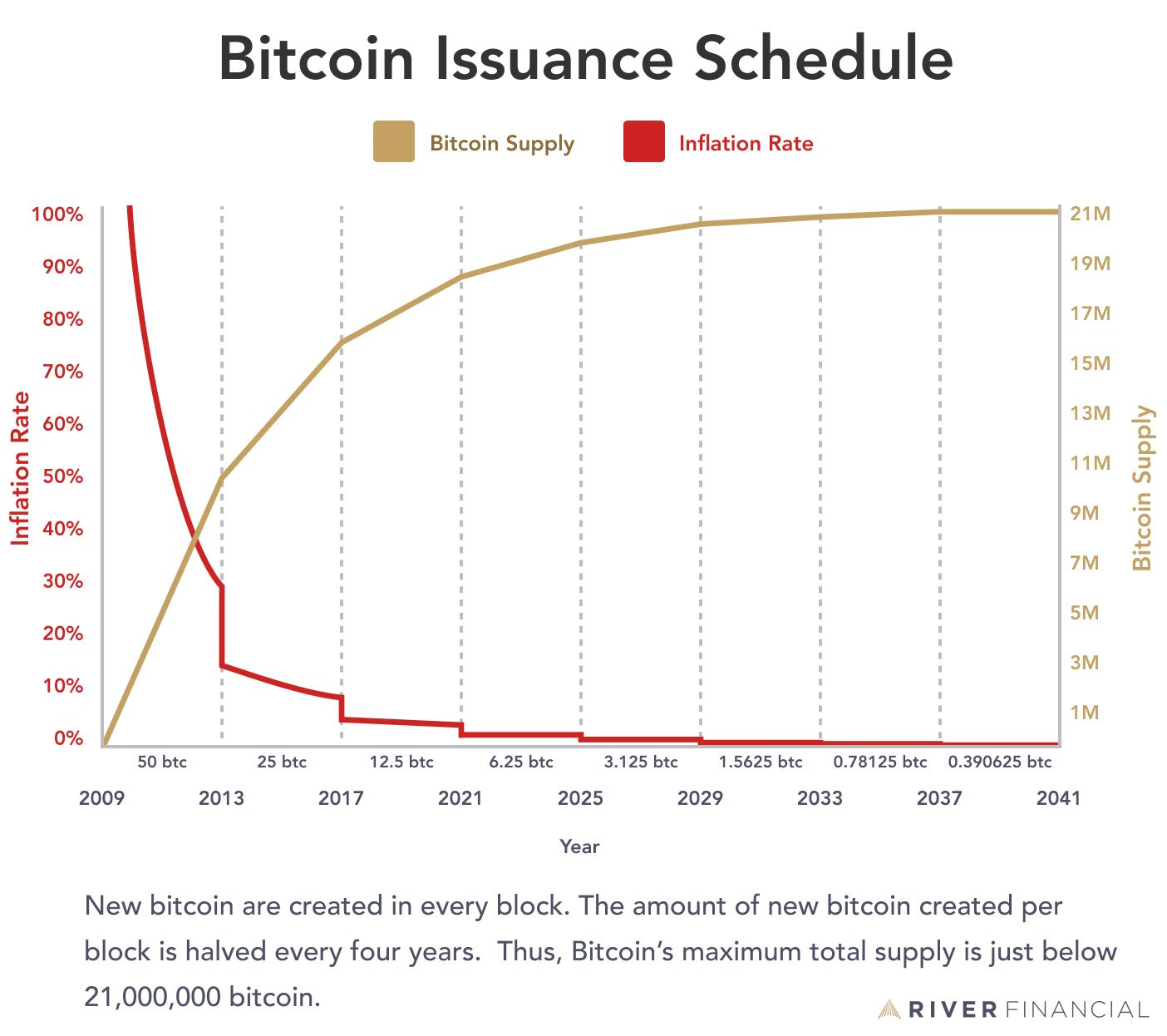

The second chart shows the Bitcoin Issuance Schedule. There is 100% certainty with regard to the bitcoin monetary policy. It makes it very easy to plan economic activity because the inflation rate of bitcoin (newly mined bitcoin) is pre-programmed into computer code.

Pre-programmed supply schedules with fixed currency issuance are helpful because they project into the future and guarantee what the inflation rate will look like for an economy as the money supply increases. Since the total supply of bitcoin is capped at 21 million BTC this makes it very easy to maintain a constant standard and not change the protocol.

This also makes bitcoin a much better common currency than the dollar and in my VERY strong opinion a better form of long-term savings.

For the leave it to beaver types that think we should return to a gold standard, Bitcoin is a better common currency than gold for many reasons. Here are some…

1. Bitcoin is more liquid than gold, meaning it can be transacted much faster and with less effort. This makes it much easier to access and use when you need it.

2. Bitcoin is digital, meaning it is not subject to the same physical limitations as gold. It exists on a global, digital ledger, allowing it to be transferred almost instantaneously and without hassle.

3. Bitcoin is more secure than gold, as it is virtually impossible to counterfeit. All transactions are recorded on a secure, immutable blockchain, making it virtually impossible for anyone to duplicate or manipulate Bitcoin.

4. Bitcoin has a fixed supply of 21 million. Gold supply is unknown.

5. There can be no counterfeiting of Bitcoin, whereas fake gold abounds in the market.

Bitcoin as the denominator

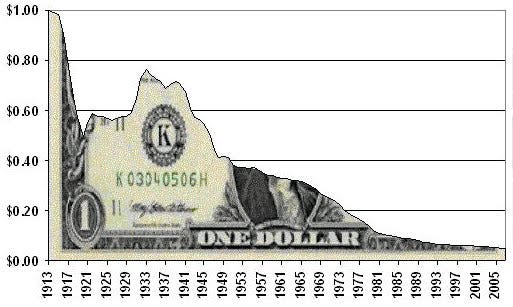

In theory, a common currency should also be a savings vehicle. Saving money is essential for individuals and businesses to ensure financial security and growth. Holding fiat currencies as a savings vehicle has been a bad decision, as inflation and new money supply has wrecked the purchasing power of the dollar overtime.

Firstly, fiat currencies are backed by the faith and trust in the government and are, as we’ve seen in recent weeks, subject to the same risks as other investments. Here’s a great Spotify podcast with Bari Weiss and Tyler Cowen that discusses the situation. This interview discusses that the so-called safest asset in the world, or otherwise known as US Treasury Bonds, became the riskiest assets in the world after the Federal Reserve started increasing interest rates in 2021.

Holding fiat currencies as a savings vehicle is something legacy monetary monarchies would like you to do, and it’s time to move to a better standard, otherwise we risk the inherent problems with a one-world currency like central bank digital currencies (CBDCs). Holding bitcoin is a statement to opt-out of this system and grow a new world were more citizens prosper and the geni-coefficient normalizes.

Bitcoin maximalists believe with unwavering conviction that Bitcoin is the only cryptocurrency, in fact currency, worth caring about. What worries me are the hardline bitcoin maximalists who recreate the formula by removing the numerator. In order for there to be more than a single currency there must always be a numerator that is something other than bitcoin. That numerator may include stocks, bonds, fiat, goods, services and other crypto currencies. When the numerator and the denominator are both bitcoin you have created a one-world currency. In a scenario where bitcoin is the only currency I think wealth inequality could sky-rocket and the geni-coefficient potential reach a level higher than we’ve ever seen.

Unlike other savings products, Bitcoin can be converted into other cryptocurrencies, stable coins and local digital currencies. These digital currencies can be can be transferred quickly and easily, allowing individuals to move their savings around the world with relative ease.

The good news is that Bitcoin is 10 million times better as base layer currency than any government issued fiat currency. Holding bitcoin as a savings vehicle can provide a hedge against inflation and protect one’s savings from the effects of inflation theft overtime.

Using bitcoin a bitcoin standard simply means choosing bitcoin as the denominator (base layer) by which everything is measured against. In theory, instead of valuing goods and services in dollars terms it is more ideal to start valuing them in bitcoin terms. It’s a paradigm shift in thinking but the fact that 1BTC today = 1BTC tomorrow is something never to lose hold of.

Survival of the fittest and the ability to opt-out

Many people today are opting out of the fiat system and taking a step in the right direction when going with Bitcoin, the best form of money ever created. The option to opt-out of a bad monetary system should not just stop at Bitcoin however, and there should always be a desire to create a better form of money that is more efficient, secure, and reliable than the existing system. Bitcoin is certainly a better savings vehicle than bitcoin for those who have a long-term horizon and are patient. In the future as adoption increases more and more will begin to use bitcoin (and perhaps some other cryptos) as a medium of exchange.

By creating a fair and open market for alternative currencies, innovators can develop and improve upon existing technology and offer more efficient, secure, and reliable solutions for managing finances. This would help to foster a more competitive and efficient market for all users. Allowing for alternative currencies creates a more level playing field for individuals, businesses, and governments. It gives users freedom to choose the currency they prefer and puts them in control of their finances. This would help to reduce economic inequality and give more people access to financial services.

Replacing fiat with bitcoin as the denominator in the equation would create a more stable situation for everyone. A Bitcoin standard would only allow for the most solvent and productive alternative cryptocurrencies and businesses to survive. Zombie companies with zero revenue will fail quicker as nobody would lend them an appreciating asset (bitcoin) if their revenue couldn’t pay back the loan. This would create a much more stable and secure market, as only the most reliable and innovative cryptocurrencies and business would remain in circulation.

In conclusion

Cryptography is a technique that uses mathematical algorithms to transform data into a form that unintended recipients cannot understand. It makes secure data transmission over the internet possible by preventing unauthorized parties from reading or tampering with it. Cryptography is not corruptible, but attackers can bypass cryptography by hacking into computers that are responsible for data encryption and decryption, and exploiting weak implementations such as the use of default keys. However, cryptography makes it harder for attackers to access messages and data protected by encryption algorithms. Because of cryptography we can finally have a sound monetary system built on the hardest money every created, which of course is Bitcoin. So, if you still don’t have any bitcoin I’d highly suggest getting some.

But just because cryptography provide these benefits to society does not make the human creators sovereign individuals with a sovereign currency. God is more sovereign than cryptography because He created and rules over the universe, while cryptography is a man-made system. Cryptography is a tool that can be used to secure data, but it is ultimately limited by its human creators. God, on the other hand, is the ultimate ruler of the universe and has the power to create and destroy anything He desires. He is not limited by human understanding or knowledge, and His power and authority are far beyond that of any man-made system. Ultimately, God is more sovereign than cryptography because He is the ultimate ruler of the universe, and His power and authority are far beyond that of any man-made system.

One way to prevent any form of maximalism from imposing dogmatic ideology is by having separate powers. This is idea is something the United States Constitution is built on. The importance of having Bitcoin as a base layer currency (the denominator) with digital local currencies that can easily be exchanged for it (the numerator) is analogous to the Constitution of the United States and the separation of federal and state powers. Just as the Constitution provides a framework for the federal and state governments to operate within, Bitcoin provides a framework for digital local currencies to exist within. Just as the Constitution ensures that the federal government has the power to set laws and regulations, Bitcoin ensures that digital local currencies are secure and can be exchanged for Bitcoin. Just as the Constitution ensures that the states have the autonomy to make their own laws and regulations, Bitcoin ensures that digital local currencies have the autonomy to set their own policies and regulations. In this way, Bitcoin provides a framework for digital local currencies to exist and operate within, much like the Constitution provides a framework for the federal and state governments to exist and operate within.

Going back to the theological theme of this article, another thing our founding fathers got right, which was established by the First Amendment, was separating church and state. However, they missed a crucial piece, which was the need to separate church and money. That is the reason I don’t agree with the use of “In God We Trust” on money. This is statism masquerading as a deity. Stateism can be a harsh ideology that flies in the face of the American values of freedom, liberty and justice for all. I recently Tweeted about this…

So, be careful of anyone who lifts Bitcoin to the same level of God. These maximalists want you to worship the immaculate conception of bitcoin as if it were the reincarnation of Jesus himself.

Thanks for reading this article. Please support my work by subscribing to a premium membership today!

Tief’s Takes

Tief’s Takes are brief memos to help you navigate financial markets conditions, the economy, blockchain, cryptocurrency and personal finance. None of this is financial advice, blah blah blah.

Who is Tief

Jeffrey J. Tiefenthaler is the founder of Trading Tech and Consulting LLC. He is an experienced FinTech entrepreneur, accredited investor, and brand ambassador with two decades of experience trading in US stock and options markets, 15 years consulting for Microsoft brands such as Xbox, Windows and Bing. He’s been featured in CoinMarketCap and awarded number one for articles with the highest views, top 10 for projects by Engagement Growth, top 10 for projects by community followers gained.

PS - I wrote this article with the help of AI using my new skill - prompt engineering =-)