What is Cognitive Dissonance

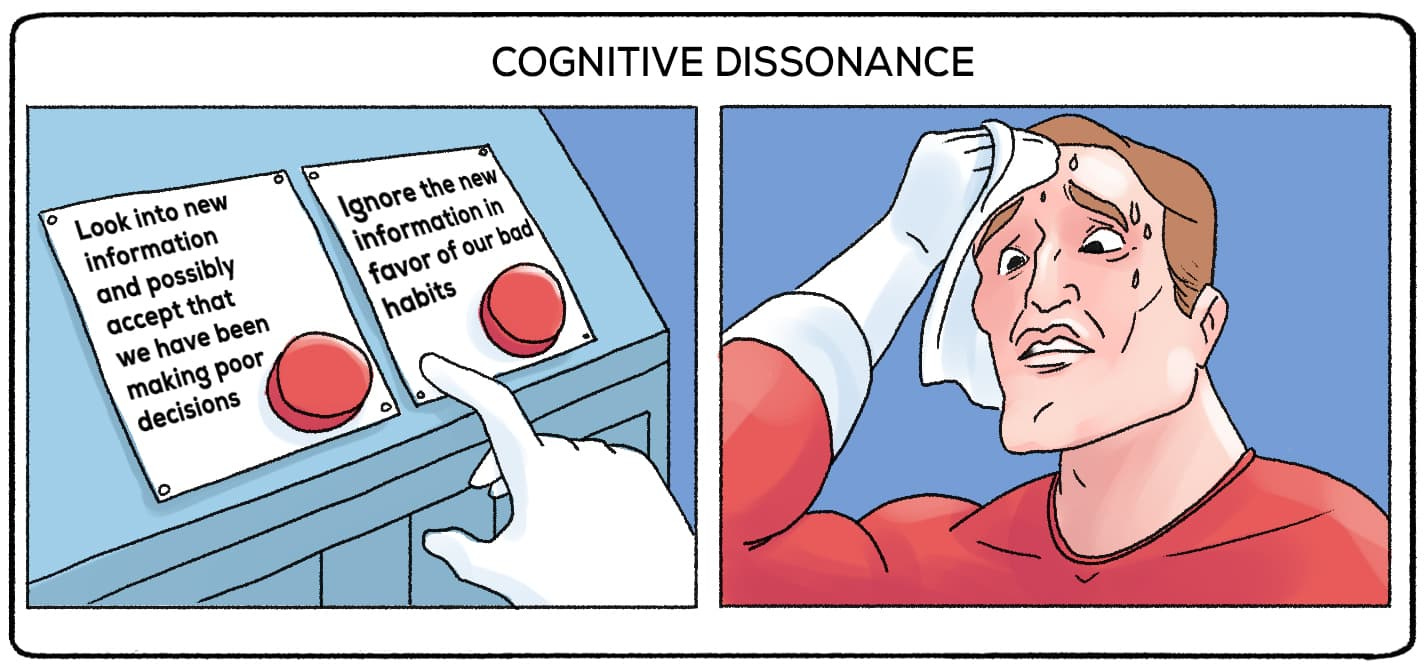

There's a psychological concept lurking in the shadows that demands your attention—cognitive dissonance. It's that discomfort, that tension you feel when your beliefs clash, when your actions contradict what you hold dear. Our minds crave consistency and harmony, and when faced with cognitive dissonance, unease, frustration, and internal conflict are sure to follow.

Now, here's the kicker: being aware of cognitive dissonance is crucial when it comes to trading and investing. Why? Because it's our response to this internal discord that can make or break our decision-making. We humans have a knack for employing various cognitive strategies to resolve cognitive dissonance. Some of us seek out information that confirms our existing beliefs, conveniently ignoring any conflicting data (hello confirmation bias). Others downplay the significance of that contradictory information, desperately trying to reinterpret it in a way that aligns with what we already hold true (cue cognitive restructuring). And let's not forget about the power of social validation—we gravitate towards like-minded individuals, surrounding ourselves with those who reinforce our perspective and diminish the dissonance.

How it applies to Investing

In the realm of finance, trading and investing, understanding and recognizing cognitive dissonance becomes a game-changer. It's about acknowledging the potential clashes in our beliefs, evaluating conflicting information with an open mind, and resisting the temptation to cling to preconceived notions. By doing so, we equip ourselves with the tools to make more informed decisions, adapt to market fluctuations, and steer clear of the pitfalls that cognitive dissonance can lay in our path. Remember, being aware of this psychological phenomenon is your secret weapon in the quest for successful trading and investing.

Senator Elizabeth Warren's stance on cryptocurrency highlights an example of cognitive dissonance in her approach. On one hand, she often advocates for individual freedom and economic empowerment as well as opposes malpractice in the banking and financial sector. However, when it comes to cryptocurrencies, she expresses a desire to impose bans or stricter regulations. There is inconsistency between supporting freedom and advocating for restrictions in the crypto space suggests cognitive dissonance in her views.

Belief in Belief

In today’s information age we are bombarded with information which can make cognitive dissonance an even greater struggle. From the news we trust to the social media groups in which we participate to the friends with whom we communicate, many of us absorb ideas from sources who tend to share and reaffirm our existing opinions (me included).

Many times, we find ourselves digging our heels in the ground even when there’s evidence that contradicts our beliefs. This feeling of believing that you should believe something—despite realizing it’s absurd—is what philosopher Daniel Dennett calls “belief in belief.”

This phenomenon appears in everyday life. Dennett explains that the entire financial system hinges on belief in belief. For instance, politicians and economists realize that a sound currency depends on people believing that the currency is sound—even if there’s proof to show otherwise. This is evidenced by the growing government debt, purchased by institutions and governments in the form of Treasury Bonds. These institutions buy and hold bonds because of their faith that the US Government is too big to fail. Once the US went off the gold standard in the 70s’ the only thing backing the dollar became the believe in the US Government itself.

Why does cognitive dissonance occur? In large part, because the human brain craves predictability, and it feels betrayed when “trusted” sources change their positions. In order to alleviate the unease, we will make extensive efforts to rationalize the incongruity.

Barden’s Cognitive Dissonance Experiment

In 2008, Howard University psychology professor Jamie Barden ran an experiment to determine how people processed inconsistent behavior of political candidates. He told a group of students—half of whom identified as Republican and half as Democrat—to judge the behavior of a hypothetical guy named Mike.

The students received the following information about Mike: He had organized a political fundraiser, had a little too much to drink, and crashed his car on the way home from the event. A month after the incident, Mike went on the radio and preached to listeners about how no one should ever drive drunk.

There’s two ways to interpret Mike’s behavior: 1) That he is a hypocrite or 2) that he learned and grew from his mistake. So how did the participants in the study judge Mike’s actions?

Here’s the key detail: Half the time Mike was described to the students as a Republican and half the time he was described as a Democrat.

When Mike was presented as being of the same political party as the study participant, only 16% of the participants judged him to be a hypocrite. But when Mike was presented as being from the opposing political party, 40% judged him to be a hypocrite.

In other words, when someone acts in unpredictable ways, it’s difficult to change our beliefs and easier to change our interpretation of their actions to make them more congruent with our existing beliefs.

Tetlock’s Cognitive Dissonance Experiment

Psychologist Philip Tetlock concluded that the political world is divided into two groups of people whom he calls foxes and hedgehogs. (Based on the ancient Greek aphorism, which says the fox knows many things, but the hedgehog knows one big thing.)

Tetlock says that some leaders behave like hedgehogs: They have one big worldview based on what they see as a few fundamental truths, and these people are highly consistent. The foxes, on the other hand, tend to be very inconsistent because they are guided by drawing on many diverse strands of evidence and ideas.

Tetlock conducted a massive study over 20 years to look at how accurate “foxes” and “hedgehogs” were in predicting what the future was going to look like. In the end, he found that over time, foxes tend to be much more accurate than hedgehogs.

Why? Because for a fox, being wrong is an opportunity to learn new things, so they are much better equipped to deal with the complex and unpredictable things life throws their way.

Tetlock’s work has challenged the idea of what it means to be an expert. We may think of experts as these knowledgeable figures who are entrenched in their beliefs and never flip- flop. Rather, Tetlock says, the experts whose predictions often turn out correct are those who frequently hedge their predictions and evaluate multiple possibilities on a spectrum. These experts use terms like “but,” “however,” and “although” to express alternative views that fall somewhere on the spectrum of possibilities.

As a stock market trader, embracing the mindset of a fox rather than a hedgehog can prove advantageous. The ability to consider diverse perspectives, analyze a wide range of data, and adapt strategies in response to market fluctuations can lead to more informed decision-making and ultimately enhance trading performance. By being open to learning from mistakes and remaining receptive to new information, traders can navigate the intricate world of stocks with greater success.

The Balaji Interview

In the realm of modern-day foxes, there emerges a figure whose presents overarching evidence that modern day elite hedgehogs - the woke establishment - doesn’t want to acknowledge. I speak of none other than Balaji Srinivasan, a Paul Revere of our times, heralding the world to the consequences of the invasion—the invasion of a woke mind virus - a philosophy entrenched in a cult-like belief system with virtually zero nuance.

This insidious force seeks to infiltrate our minds, infecting our thoughts with its ideological dogmas, eroding critical thinking, and stifling dissent. Its implications ripple through the fabric of our society, even extending to realms such as Central Bank Digital Currencies (CBDCs).

In this riveting interview Balaji paints a bleak picture of a divided States of America emulating the Chinese Communist Party and following the footsteps of the Soviet Union right before that empire fell.

During this interview, Balaji skillfully illuminates numerous striking parallels between the present state of affairs in the United States and the days of the Soviet Union, moments before its eventual collapse. Moreover, he compellingly highlights disconcerting political choices that bear an uncanny resemblance to the very practices freedom loving Americans vehemently oppose—the tenets of the Chinese Communist Party. It’s a good example of a though provoking interview you will not find presented by the entrenched main-stream media oligarchs (modern day hedgehogs).

In this interview Balaji challenges the status quo, which is not act of rebellion; it is a vital ingredient for progress and societal evolution. It is through questioning the established norms, ideas, and systems that we unearth new possibilities, identify shortcomings, and foster innovation. In the realm of governance, business, and social dynamics, a healthy dose of skepticism and constructive criticism plays a pivotal role in driving positive change.

The establishment, in all its forms, must remain open to criticism, for without it, complacency takes hold, creativity stagnates, and progress grinds to a halt.

The woke mind virus - embracing cancel culture, Marxism and CBDCs is a slippery slope which Balaji argues will lead to a breakup of the United States.

I don’t agree with everything Balaji says but amidst this turbulent battleground of ideas, Balaji Srinivasan stands tall as a messenger, delivering a warning that some may find uncomfortable, even unsettling. Let us not forget, shooting the messenger does not silence the truth. Instead, let us heed the call, engage in thoughtful discourse, and fortify ourselves against the encroaching dangers.

Unbeknownst to the fish swimming in its cozy fishbowl, it remains blissfully unaware of its aquatic abode, ignorant to the fact that it dwells within the very essence it breathes—water.

As my readers know, I am Bitcoin evangelist and speak on the merits and superiority of bitcoin for hours on end. I am aware of the cognitive dissonance of many Bitcoiners however, and while I simultaneously hold the belief that Bitcoin is the best form of money ever created, I acknowledge the importance of having multiple currencies in existence - crypto, local or otherwise. I wrote about this in my article - Where I draw the line with Bitcoin maximalism.

Where I draw the line with Bitcoin maximalism

As the son of a pastor raised in small community church, I have been exposed to the importance of money in the Bible since a young age. Jesus spoke more about money than any other topic in the Bible, and this is due to the fact that money has a profound impact on our lives and our relationship with God. Money can be a powerful tool for good, but it can …

Here is Balaji Srinivasan’s interview video:

It's important to remember that not everything is negative and there's a positive aspect you can embrace before it becomes too late. If you share my belief that the fiat currency system is in trouble, I encourage you to secure your Bitcoin parachute. Should you require assistance in understanding Bitcoin, feel free to reach out to me.

Thank you for taking the time to read this. I hope that the information provided has been informative and engaging. If you have any further questions or would like to continue the discussion, I look forward to connecting with you soon. Your feedback and insights are valuable to me, and I appreciate your interest.

Subscribed

Kind Regards,

Jeff Tiefenthaler

Jeff Tiefenthaler is the founder of Trading Tech and Consulting LLC.

Jeff is an experienced FinTech entrepreneur, accredited investor, and brand ambassador with two decades of experience trading in US stock and options markets, 15 years consulting for Microsoft brands such as Xbox, Windows and Office. He’s been featured in CoinMarketCap and awarded number one for articles with the highest views, top 10 for projects by Engagement Growth, top 10 for projects by community followers gained.

Please contact Tief for a free consultation today!